The best bank for expats in Madrid

Read this article to learn the best bank for expats in Madrid and to get the details of English speaking branches our customers have successfully worked with.

Sabadell

Sabadell offers zero-fee accounts and you can open an account from outside Spain before arriving in Madrid.

Why Sabadell is one of the best banks for expats in Madrid:

- No fees and no commissions, even for international transfers within Europe. Transfers to the UK and the US do incur fees. For large transfers outside of the EU, we recommend using a foreign currency specialist. You can save up to 3% using a currency broker.

- Sabadell gives you back 1% on all utility bills.

- Secure online banking in English

- Customer Service in English: Nelida at The Miguel Angel Branch will make sure everything goes smoothly. Sabadell has contracts in English. They will call you when your cards are ready, or when something strange is happening on your account,

- There is only one condition to keep your account feeless. You must have a minimum of 700€ a month transferred into the account. If you are under 29 years old, there is no minimum transfer requirement.

To get started, simply click the orange button below to send an email to the Miguel Angel 23 Branch (Metro Gregorio Marañon). Include a scan of your passport, your telephone number and your home address (it’s ok if it’s not in Spain).

Or you can directly email them at: fernandezalvarezsusana@

Get a special Sabadell account now

By going through Moving2Madrid, and working with the Miguel Angel 23 Branch, you will get special treatment. They will inform you of the special offers they have for Moving2Madrid customers and your account will be opened quickly, even before you arrive in Spain.

To keep all the advantages listed above, make sure you get your NIE and send it to them within the first 3 months so you do not get the non-resident tax of 26€ from the Spanish state. You can check the conditions in this summary.

Caixa Bank

CaixaBank is another excellent choice for expats. The bank has the best English resources and an English help line. They offer a special program called HolaBank, which is aimed at international clients. They offer high-value financial support, advice and guidance service tailored to meet your needs.

Why Caixal is one of the best banks for expats in Madrid:

- Free debit and credit cards

- Free Visa&Go card for the first year. Visa&Go is a credit card with deferred payments. The amount spent on the card is repaid in fixed instalments and the outstanding balance does not incur any interest. The maintenance charge is free in the first year, and free in subsequent years as long as you make purchases for an accumulated minimum of €600 a year (€25 a year in other cases).

- 24 free transfers per year within the EU. Again, transfers to the UK and the US do incur fees. For large transfers outside of the EU, we recommend using a foreign currency specialist. You can save up to 3% using a currency broker.

- Free conference call/translation services. Their team of interpreters will speak for you on the telephone to help you handle whatever you’re doing. They will also provide simultaneous translation services in English, French, German and Russian.

- CaixaBank will help you set-up all your utilities when you arrive in Spain.

- Assistance with home emergencies.

- Secure online banking in English

- Customer Service in English: Almudena at Calle Velasquez office will make sure everything goes smoothly. They have contracts in English. They will call you when your cards are ready, or when something strange is happening on your account,

- A variety of other non-banking services such as telephone medical service, helping you find domestic staff, a handyman service, etc.

To get started, visit their Calle Velasquez office and mention that you are a Moving2Madrid client. That branch has offered outstanding service to past clients. If you are looking for a mortgage, Caixa has the best rates and service.

About banking in Spain

Please keep in mind that banking is Spain is still a bit old-fashioned. All major transactions have to be done in person at the office where you opened your account. There is a great variation in service levels and English proficiency. Moving2Madrid vouches for the Sabadell Office at Miguel Angel, 23 in Madrid, and the Caixa office on Calle Velazaquez, in Madrid. They will answer your questions and make things happen. If you contact other offices in Spain, we cannot make any promises regarding the quality of service. Moreover, it is important to note that banking in Spain is still done on a branch basis. So if you open your account at one office, you will need to return to that same office for all but the simplest of transactions.

If you have any issue, just comment on this post and we will help you get it resolved. We cannot vouch for the rest of Sabadell or Caixa offices in Spain. We know these two and have requested special services and attention from them. If you have any more questions or doubts about the best banks for expats in Madrid, send us an email today and we can answer your questions.

Full disclosure: M2M does not have an exclusive agreement with Sabadell or Caixa. However, both banks reward referrers. Other banks, for instance ING, do the same. We refer our readers to Caixa and Sabadell because both have treated our clients exceptionally well in the past. Moreover, English is spoken in both branches we mention.

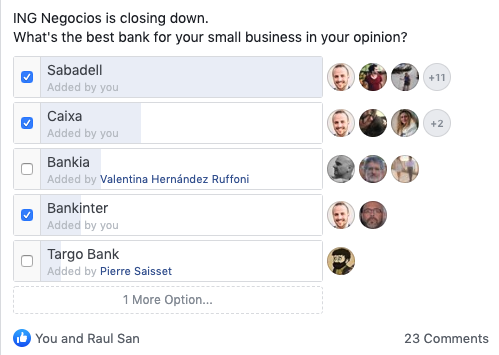

In fact, we did a survey on an expat facebook group and here are the results for freelancers and small business – exactly the same, Sabadell and Caixa first!

Posted on 4 March, 2021 by Pierre-Alban Waters in Living in Madrid, New? Start Here

[…] is needed to make a serious offer. If you are unsure which bank to use, we invite you to read: The best bank account for expats in Madrid. If you are a Moving2Madrid client, our Transaction Coordinator will help you open your account […]

Honestly I don’t know. Sabbadell still is great for expats, but this post was written awhile ago and I don’t know if Nelida is still there or not. I would try emailing her. Please report back about your experience!

Is this still relevant now in 2018? Will I be able to reach this person Nelida if I email? Thanks

I know about Madrid – Do get in contact with Nelida at ariasnelida@bancsabadell.com to make sure for Granada !

We have bought a house for holidays in the Granada area and need a bank account, we have NIE certificates. Would this account be suitable and is the 26 Euros a yearly charge.

Thanks Steve

Dear Marzio,

First of all thank you for your question and Merry Christmas!!!

EVO has this special feature because it was funded in 2012 by NCG group as a young bank with a strong online presence. So their focus was not to open many branches like traditional banks. Sabadell uses the Servired network, so you can withdraw cash from any Servired ATM point with no extra charge(50% of the total, Telebanco is the other network where 50% of the remaining banks apply). For any further questions you can call Sabadell at 902 343 999 (also in english) or ask our Sabadell contact, Nelida ariasnelida@bancsabadell.com

Hey Pierre, i see you mentioned EVO. I like EVO because of the transparency, i know that with their debit card i will not be charged for extracting money in any ATM in Spain (or in the world).

I tried to find the same informations on Sabadell site and got frustrated.

Do you know where can i find those informations on sabadell’s site?

Thanks

We can now say that the Miguel Angel Sabadell branch with Nelida is back to giving top notch service. They have requested personally a meeting and committed to answer all requests comming through our recommendation to be responded within 48h.

We have been monitoring service in the last months, and we can say it has been top quality. Myself and my team have accounts for personal and business use at Sabadell, and can also personally vouch for their quality.

Again, the uniqueness of this bank branch is that they enable us to open the account before you even arrive in Spain, and we can directly request top quality personal service.

Do post comments if any of you see any change, good or bad, at the Miguel Angel branch !

Cheers

PS: For Transfers out of the Euro zone, we have negotiated the fees and they are the following:

– To send a transfer: 0,30% fee, 6€ minimum

– To receive a transfer: 0,10% fee, 3€ minimum

Hi Melissa,

Yes, we agree that Sabadell’s service quality has been going down.

Therefore, we still recommend them as the easiest account to open when just landed, but recommend ING or EVO for banking further down the road.

One thing: the 26 € fee each term is not from the bank, but a tax from Spain for all non-resident bank account.

We are in the process of finding another bank who gives our clients and readers the same special treatment as before. We will update the article as soon as ur negotiations are fruitful.

Cheers

Just thought I would offer some recent experience of this; I went to Sabadell on this recommendation, and just be careful are there are “hidden” fees they don’t tell you about until you’re signing! This account is a non-resident account, which is great, you think, as you can open it whilst you are dong the rest of the essential tasks in order to get your official residency… BUT… if you don’t change to a resident account asap they charge 26euros (not sure if this is a month or a quarter, but still!) – they won’t accept padron, NIE, etc, it must be the official residencia, which is a pain to get a suitable appointment for, and apparently you also cannot guarantee how quickly the card or cert arrives in the post, so essentially, Sabadell will charge you!

This is NOT made clear at the outset.

I have also found the communication poor, it took me numerous emails to Nelida to get her to answer a simple question, and I opened the account weeks ago, but haven’t heard a thing regarding when our debit cards will arrive.

Subsequently, I’ve not got much faith in them now and haven’t deposited any funds yet as I am now looking at other banks as I’m overly frustrated by Sabadell & Nelida’s poor service, and will probably close the account down before I’ve even got close to using it.

I’ve heard of someone having a positive experience with the Colon branch of Sabadell, but have to say the one advertised here has been far from this, so just be aware things aren’t necessarily as they are portrayed!

Yes, Marie Helene left, and her assistant Nelida has now been promoted

Thanks Pierre!

Hi Liam,

It depends on both Sabadell and ING. Do contact SILVIA REGUEIRA SAINZ at sregueira@sabadellatlantico.com to get all the details.

Cheers,

Pierre

Hi Pierre

I am a New Zealander who has just arrived in Spain. I assume I can send money from ING back home and vice versa as required? Do you know what fees are charged?

Thank you, Liam

Hi Michael,

Yes, it is the best option I have found for our clients.

Yes, there are fees for transfers from another currency, as always, but this is defined by the bank sending the money.

All the best

Pierre

Sounds like a good option.

So, there are no fees for transfers from the UK? It just mentions no fees on Euros transferred on their website.

Hi Pepe,

I specify Madrid because customer servie differs a lot from branch to branch ! Therefore I recommend one specific branch in Madrid, where I know a specific person, Marie-Hélène, has the level of customer service I have with my clients.

And that’s very rare, and the only one I know in Madrid !

Then the bank is indeed the same all around Spain, apart from the specific deal I have got from them for the people I recommend to this branch. So all of this makes it quite location-specific !

If you have any question, just tell me !

All the best,

Pierre

Why should there be special treatment for bank customers moving to a specific region?

ING is a very good bank, and very interesting if you have a Spanish salary, a NIE and speak Spanish. It’s in fact one of my 3 banks, with Sabadell and Evo.

And as always, bad experiences can happen. What I’m sure of is this: please contact Marie-Hélène RoucouMarieHelene@sabadellsolbank.com and tell her everything that went badly. She will try to make it up to you, she has an amazing sense of customer service, speaks 3 languages, and keeps me always in the loop. ING is very efficient via email, but a bit dodgy for speaking English and being personal – no dedicated agent.

Hope you find solutions to your banking needs !

Totally agree ! Caixa is not bad in terms of serivce, but the top 3 banks are clearly (according to global ratings and rankings) Santander, Sabadell and BBVA. Caixa is going through some debt issues. But good service indeed !

I had very negative experiences with this bank. It took them three months to give send me my debit card, they subscribed me to a credit without my acknowledgment. Whenever I went to the bank they were very incompetent and rude. Oh and most of the branches are closed during the summer.

I’m moving to ING, they have been efficient and helpful.

Agree on the Banco Sabadell- Marie-Hélène in the main branch at Miguel Ángel 23 is a great French/English speaking contact. The Caixa isn’t bad either- they have lots of small branches (at the moment!) with mostly young staff who probably speak English.

Both banks (as far as I know) are pretty sound- good if you think about the crisis.